But it works differently from the more common and familiar 529 savings plan. UFund College Investing Plan Massachusetts UNIQUE College.

How To Choose 529 Plans For Your Child S Education Moneygeek Com

This plan is designed to encourage parents to save for future college.

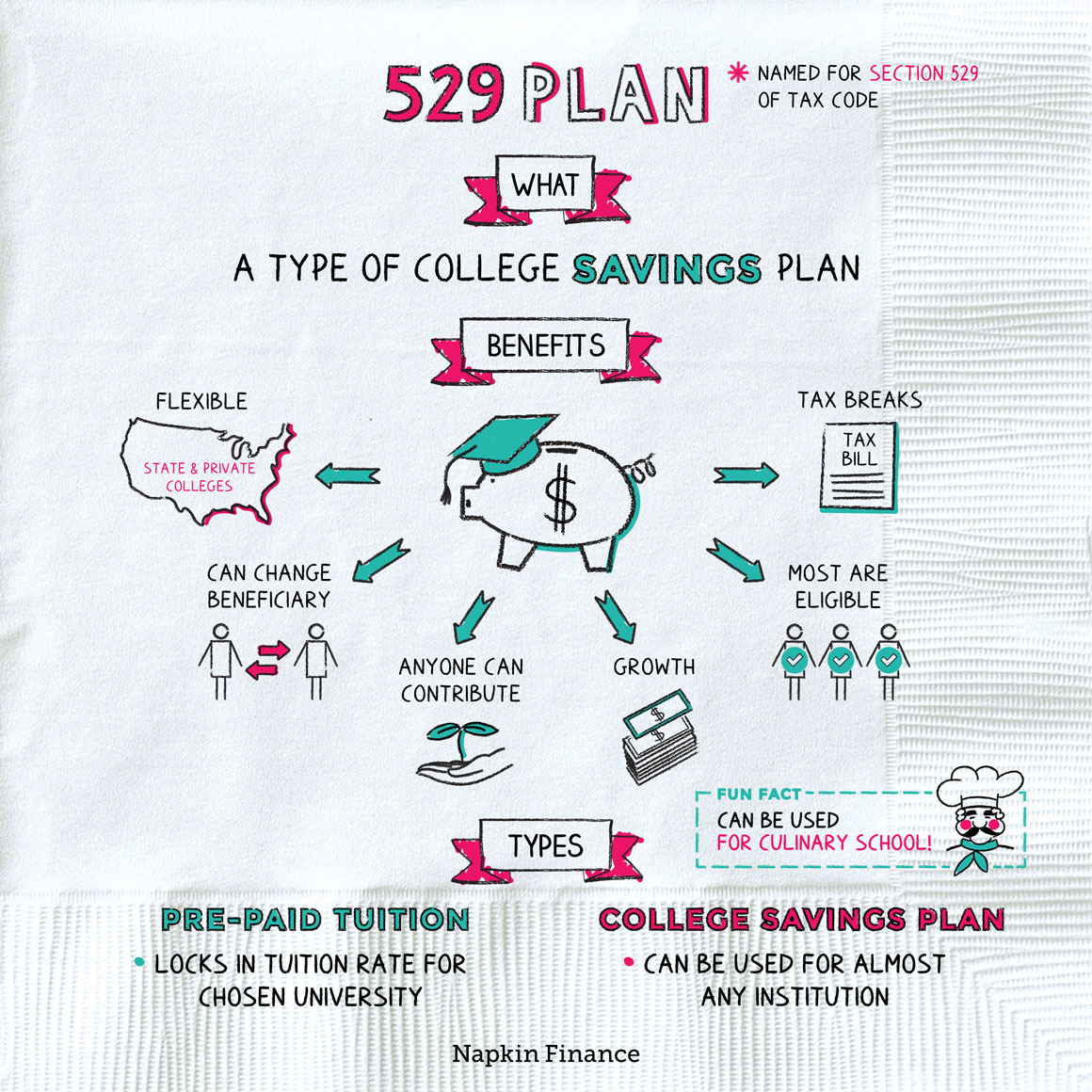

. You can use a 529 plan to pay for. A 529 plan is a tax-advantaged savings and investment plan that has one essential mission - to save for future family education costs. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs.

529 Plan is an educational investment plan through which parents or grandparents can save money for their child or grandchild and can save tax by investing in this plan as there is no tax. Thats because 529 savings are considered parental assets. You must be a US resident at least 18-years old and have a Social Security or tax ID number.

The college savings plan snagged its tenth-straight Gold rating from Morningstar in 2020 evidence of the states prudent. Ad Why Invest in a Vanguard 529 Plan. One of the more expensive disadvantages of 529 plans centers on the 10 penalty that applies when money in the account is used for something other than qualified education.

Learn more about New Yorks 529 Advisor-Guided College Savings Program managed by JPMorgan. Ad Talk To Us About College Planning Today Feel Comfortable About Tomorrow. A qualified tuition plan.

Learn more about New Yorks 529 Advisor-Guided College Savings Program managed by JPMorgan. Earnings on 529 investments accumulate tax-free and distributions are tax-exempt as long as. Here are seven ways to put a 529 plan to use.

A 529 plan is a college savings plan that offers tax and financial aid benefits. A 529 Plan is a fancy word for a college savings account. A 529 plan is an investment account that offers tax benefits when used to pay for qualified education expenses for a designated beneficiary.

Use a 529 to pay for elementary and secondary school tuition. Earnings on 529 investments accumulate tax-free and distributions are tax-exempt as long as. By doing so you get to have your money grow.

529 plans also called qualified tuition. Another benefit of 529 plans is their high contribution limits. 529 plans legally known as qualified tuition plans are sponsored by.

A 529 plan is a tax-advantaged savings plan designed to encourage families to save for college. Another term for a 529 plan is. The requirements to open a 529 savings account are simple.

The prepaid plan allows you. What that means is that anything you put into your 529. Most plans have no annual limit and aggregate contribution limits from 235000 to over 500000 varying by.

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. If you have a 529 plan worth 10000 only a maximum of 564 would be added to the EFC. Application for this discount is annual.

Ad Discover the advantages of our NYC Advisor Guided 529 Plans for your business and clients. Plan portfolios generally invest in mutual funds managed by affiliates of Franklin Mutual Advisers LLC. 529 plans may also be used to save and invest for K-12 tuition in addition to college costs.

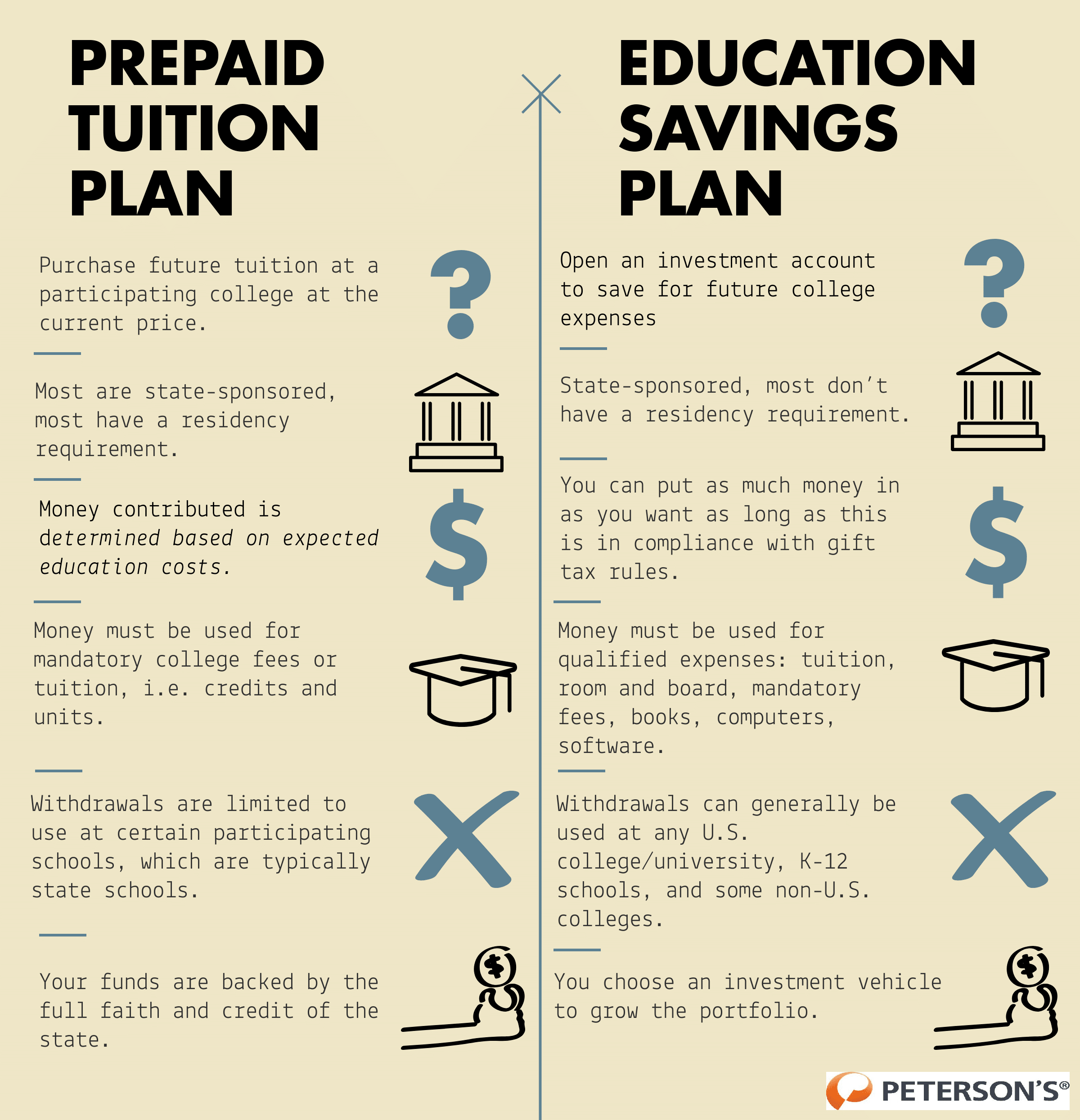

An investment in Franklin Templeton 529 College Savings Plan is an investment in a. There are two types of. A 529 is a college savings plan known as a qualified tuition plan that allows you to save money for your childs college education.

529 plans legally known as qualified tuition plans are sponsored by states state agencies or. A prepaid tuition plan is technically another type of 529 plan. 529 plans legally known as qualified tuition plans are sponsored by.

Heres what that means. A 529 plan is a tax-advantaged savings plan designed to encourage families to save for college. Ad Flexible Affordable Tax-Advantaged College Savings Program.

New Yorks 529 College Savings Program - Direct Plan. Learn How Our Plan Can Help You Save Money. Ad Discover the advantages of our NYC Advisor Guided 529 Plans for your business and clients.

A 529 plan is a tax-advantaged savings plan designed to encourage saving for educational costs. Just keep in mind that if your child or another family member is the account holder instead of you the 529 impact to financial aid could go as high as 20. Specifically a tax-advantaged college savings account.

Setting Up a Vanguard 529 Plan Early Can Save You Money on Education Costs. Receiving scholarship money to play. The grant considered the foundation of federal financial aid is called the _____.

The Best Overall 529 Plans. The other term for a 529 plan is qualified tuition plans. See Why Were Ranked Among The Top College Savings Choices Nationwide.

Due to 2018 tax reforms parents can use up to 10000 saved in. Utahs my529 program has had quite a run. 888-922-2336 888-922-2336 888-922-2336 1 hours ago Academy Sports will match the price - and discount it by another 5.

Why A 529 College Savings Plan T Rowe Price

What Is A 529 Plan Napkin Finance

Can 529 Be Used For Rent A Student S Guide Apartmentguide Com

0 Comments